- Daily & Weekly newsletters

- Buy & download The Bulletin

- Comment on our articles

Filing your Belgian income tax return online

To file online, you log in with your electronic ID card, a token or Itsme.

Itsme is a Belgian app that you can use to identify yourself with the tax office and other government services. You download the app from the App Store or Google Play and you activate it once with your bank card or electronic identity card.

With Itsme, you can login to Tax-on-Web by scanning a QR-code and with a five-digit code on your smartphone. If the QR-code does not work, you can get itsme to send a message to the app on your phone.

As Itsme is also being pushed by the banks to identify you on your banking apps, it is rapidly becoming a well known tool.

To log in with your electronic ID-card (the one with a chip), you need an ID-reader, and the PIN code you recorded when you received your ID card. If you lost your PIN code, the commune can give you another one with your PUK code (that you can find on the document that came with the original PIN code – if you don’t have the PUK code anymore, you will have to ask the commune to reset the PIN code).

Setting up the software for the e-card reader may be the trickiest part. Keep in mind that you may have problems if you do not use one of the traditional browsers (Internet Explorer/Edge, Firefox or Chrome).

My identity card doesn't have a chip

This is usually the case if you live abroad. If you do not have an eID or itsme but you want to activate digital keys to access the Government's online services you should make an appointment with a local registry office or with the “BOSA” Ministry. They will help you create alternative digital keys. Your identity will be checked on the basis of your identity card or passport. You must have your own personal e-mail address.

Once you have been identified, you will receive a letter with an activation code by mail. You will also receive an e-mail with the subject "CSAM – Mes clés numériques : activation”. Click on the red button "Activate your digital keys", that will take you to the site where you can enter the activation code. Enter the activation code and click on "next". That will take you to a screen where you can choose your own digital key. The tax authorities recommend that you activate the digital key "Security code sent by e-mail". You can find a set of instructions here.

How does Tax-on-web work?

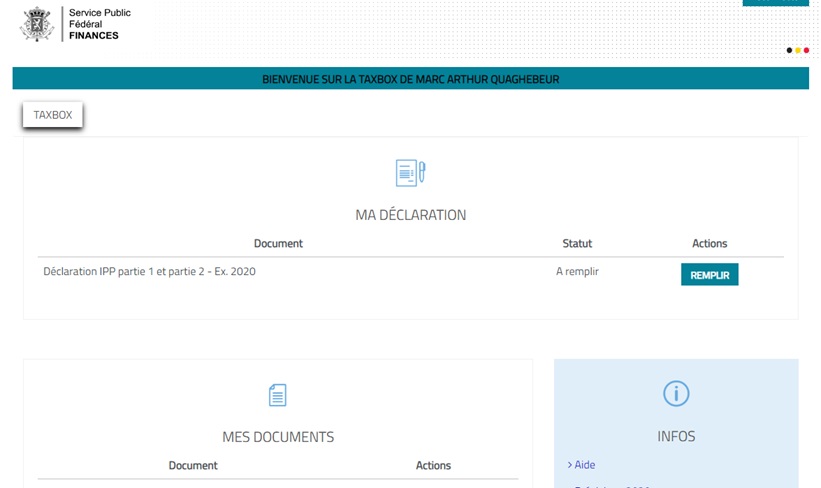

When you log in, you open your own Taxbox on Myminfin, and when you click on ‘remplir’ ou find something that looks like an actual tax return (it is the document préparatoire that normally comes with your paper tax return).

You will see that when the tax authorities already have the information, the boxes will already be filled out. That is the case for the identity of your depend;ent children, the cadastral income of your house, your salary and the wage withholding tax or your titres services. Check that the information you find is correct and that it corresponds to the tax statements you received from your employer, from the pensions office, or for your titres services etc.

On each page you can click and get online explanation, you can add a comment or attach a PDF-file. The help files don't offer much more information than the explanatory booklet that the tax authorities give you online.

Calculate the tax

Before you sign and finalise your tax return, you can calculate how much tax you will have to pay. It is a rough estimate because the calculation doesn't take account of complicated issues like cross border workers, overseas income, etc. That calculation isn't the tax bill; that will come later.

Don't forget to sign

This sounds obvious, but every year there are taxpayers who save the tax return without signing it. The tax return is not filed unless you sign with your PIN code (if you have an electronic ID card) or with your access code. Spouses and partners who file a joint tax return must log in and sign separately with their PIN code or access code. It is only when both spouses and partners have signed, that the return is filed.

When you have both signed, you receive a confirmation of the date and time of filing. I suggest you print it or save a copy.

If you have recently separated and you do not want to file jointly, you can now file separately and sign separately as well.

You can always check the summary of your tax return in your Taxbox. It isn’t a bad idea to save a copy as well. You don’t need to send a copy of the confirmation or the PDF summary.

Once the tax return is filed, you can still correct your tax return once online until 15 July. And you both need to sign again. If you need to change anything after that date, you will have to contact your local tax office. You can call them or just send them a letter saying: "in code 1030-10, please replace 1,000 by 1,500".

It is not always possible to find the address of your tax office. Keep in mind that you can send a letter by www.myminfin.be . If you have the three-figure number of the tax office. If you don’t, call the call centre at 0257 257 57.

More from our 2024 income tax guide

- When do I need to file my Belgian income tax return?

- Belgian income tax returns for families

- Online or on paper?

- Filing online

- Understanding the paper tax return

- Checklist: What documents do you need?

- The return in detail

- Belgian income tax: There's nowhere to hide

- A guide to cross-border taxation

- Help! Where to get assistance with your tax return

- Understanding your Belgian income tax bill

- How do I appeal?

- This guide was written by Marc Quaghebeur, an international tax lawyer at Cabinet DAVID. It is a general introduction based on current understanding of the law. It is not to be taken as a suitable alternative for individual advice. If you have a question, you can contact him by clicking on his name.